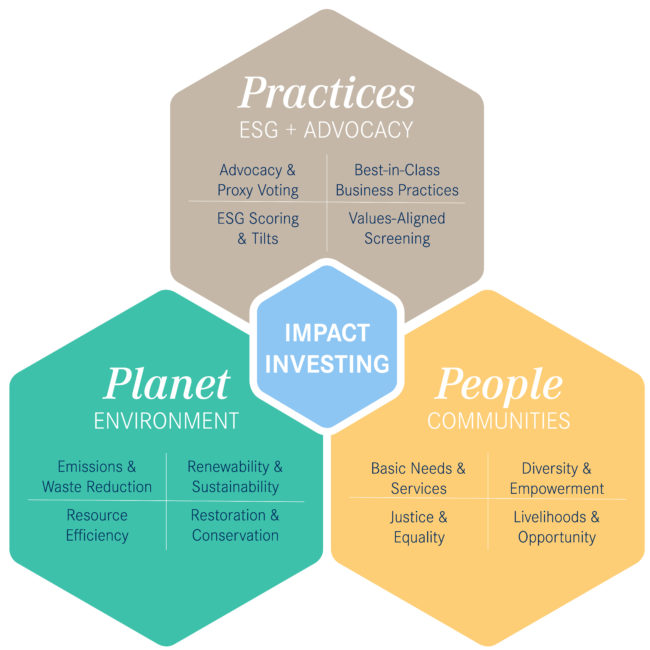

At Vida Private Wealth, our approach is to create tailored solutions that fit your specific goals and are in line with your values. There are many ways to approach investing with a social and environmental lens, including Environmental, Social, and Governance (ESG), Sustainability, Impact Investing, Socially Responsible Investing (SRI) and Philanthropy.

Quality and ESG factors mitigate risks and taxes by investing in great companies with sustainable businesses that can be held for the long-term, unlocking the power of compounding.

We leverage our traditional rigorous financial analysis to uncover opportunities in the public and private markets. Throughout this process, we give serious consideration to environmental and societal impact, as well as corporate governance considerations.

The investigation of the environmental factors includes looking into the sourcing of raw materials, manufacturing, and recycling. We do this because we believe in investing in sustainable supply chains that do not deplete natural resources. This is critical to business continuity.

Our analysis of social responsibility includes how the company relates to employees and customers. Low employee and client turnover are essential factors in building a robust and sustainable business.

Governance considerations include an evaluation of management integrity and accountability to investors. As a fiduciary, we seek company management teams that adhere to best practices. Other factors include gender equality and community engagement.

In addition to the investments we recommend, clients often have ideas for investments where we can provide expertise and analysis. We empower clients to align their mission and values with their investments.